How To Protect yourself from Defi rugs

Blockchain made it quite easy to some extent to uncover potential rugs, so all you have to do is actually do your own personal research on projects before buying into them. I will list keynotes to check out before buying into any new defi project.

1. Utility or products: Here you need to check the utility that the project is offering. Any project that doesn’t have a use case, a product or a new project, there is no road map or possible use case is a first red flag to point out.

The shibainu you know has nft, a swap dex, and a lot more on its road map. A road map, a clear and comprehensive white paper matters. 2. Liquidity lock and duration: Now liquidity is money in the pool, if the liquidity pool is low, you will have issues selling or buying.

If a coin’s liquidity is locked for some duration, it means the initial money the team inserted into the pool won’t be removed, until the duration is over. if it is removed. That’s when you see tokens move from up to zero. How to know if tokens’ liquidity is locked?

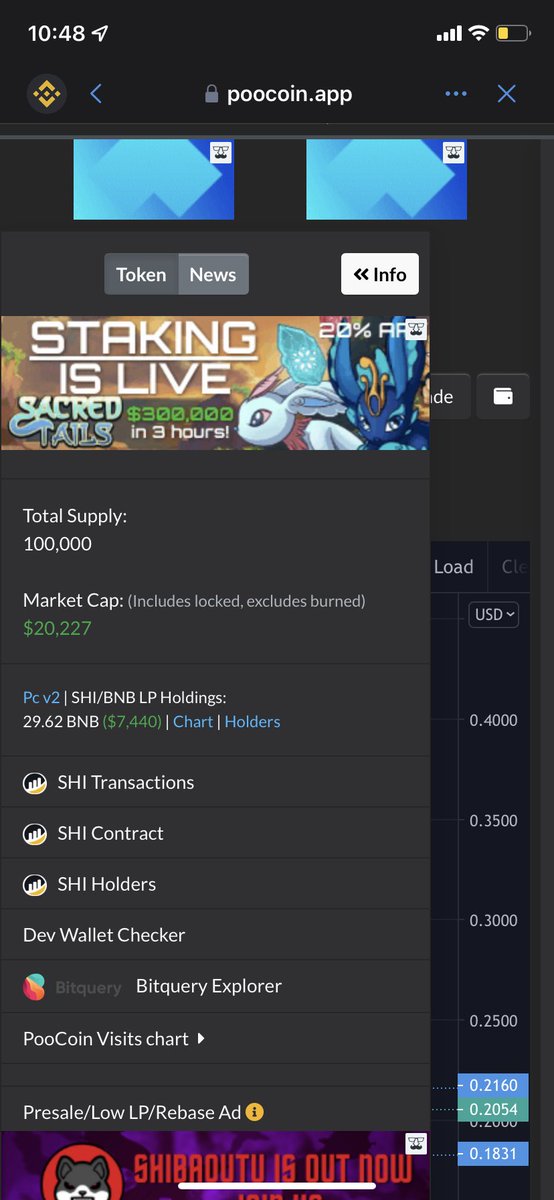

A lot of tools out there to check if liquidity is locked. But I prefer the poocoin explorer. @PoocoinBSC, they have a dex if you insert a contract address of the token you will see if the LP is locked or not. You will also see how many addresses holding the LP.

It’s a red flag.