waec Financial accounting questions and answers 2023

Here is the waec Financial accounting questions and answers 2023.

FINANCIAL ACCOUNTING OBJ

1-10 ACB

11-20#######CBA

21-30 CBCDABBAAC

31-40 CAACBCBBCA

41-50 DABBAC

1a) Incomplete records refer to a condition wherein; an establishment is not practising double-entry bookkeeping. Instead, it is practising an unconventional accounting system, namely, a single-entry system, to sustain a decreased amount of data about its financial results.

1b)

i)We cannot prepare a Trial Balance to ensure the accuracy of the accounts in the absence of the double entry system.

ii)It fails to ascertain the accurate financial results of the organization.

iii)Investigation and examination of the profitability, solvency, and liquidity are difficult. Hence, the outsiders and banks may not lend money for the expansion of the business.

(1a)

Incomplete records refers to a situation where a business or individual lacks certain essential accounting records or information necessary for accurate and comprehensive financial reporting.

OR

Incomplete records refers to a method of financial accounting where a business or individual maintains an incomplete set of accounting records. It means that essential accounting information, such as transactions, financial statements, and supporting documents, is missing or insufficiently recorded

(1b)

(PICK ANY THREE)

(i) Lack of knowledge or understanding: The business may lack the necessary knowledge or understanding of proper accounting practices, resulting in incomplete or inaccurate record-keeping.

(ii) Insufficient resources: Small businesses or startups with limited resources may not have the financial means to invest in sophisticated accounting software or hire professional accountants. As a result, they may struggle to maintain complete and accurate financial records.

(iii) Time constraints: Business owners or employees may be overwhelmed with day-to-day operations and find it challenging to allocate enough time to maintain comprehensive financial records. This can lead to incomplete or delayed recording of financial transactions.

(iv) Negligence or oversight: In some cases, business owners or employees may simply overlook the importance of maintaining complete records. They may neglect to document certain transactions or fail to follow proper accounting procedures due to carelessness or lack of attention to detail.

(v) Complexity of transactions: Certain businesses, such as those involved in international trade or complex financial instruments, may encounter transactions that are challenging to record accurately. This complexity can result in incomplete records or errors in financial reporting.

(vi) Legal or regulatory compliance issues: Businesses operating in highly regulated industries may face complex reporting requirements and compliance standards. Failure to understand or adhere to these regulations can lead to incomplete or inaccurate financial records.

(vii) Internal control weaknesses: Inadequate internal control systems within a business can contribute to incomplete record-keeping. Without proper checks and balances, there is a higher risk of errors, omissions, or even intentional manipulation of financial records.

(viii) Fraud or misconduct: In some unfortunate cases, incomplete records may be intentionally maintained as part of fraudulent activities or misconduct. By keeping certain transactions off the books or manipulating financial data, individuals within the organization may attempt to deceive stakeholders or evade taxes.

(1c)

(PICK ANY THREE)

(i) The business may lack the necessary knowledge or understanding of proper accounting practices, resulting in incomplete or inaccurate record-keeping.

(ii) Small businesses or startups with limited resources may not have the financial means to invest in sophisticated accounting software or hire professional accountants. As a result, they may struggle to maintain complete and accurate financial records.

(iii) Business owners may be overwhelmed with day-to-day operations and find it challenging to allocate enough time to maintain comprehensive financial records.

(iv) In some cases, business owners or employees may simply overlook the importance of maintaining complete records by neglecting to document certain transactions or fail to follow proper accounting procedures due to carelessness or lack of attention to detail.

(v) Certain businesses, such as those involved in international trade or complex financial instruments, may encounter transactions that are challenging to record accurately. This complexity can result in incomplete records or errors in financial reporting.

(vi) Businesses operating in highly regulated industries may face complex reporting requirements and compliance standards. Failure to understand or adhere to these regulations can lead to incomplete or inaccurate financial records.

(vii) Inadequate internal control systems within a business can contribute to incomplete record-keeping. Without proper checks and balances, there is a higher risk of errors, omissions, or even intentional manipulation of financial records.

(viii) Incomplete records may be intentionally maintained as part of fraudulent activities or misconduct. By keeping certain transactions off the books or manipulating financial data, individuals within the organization may attempt to deceive stakeholders or evade taxes.

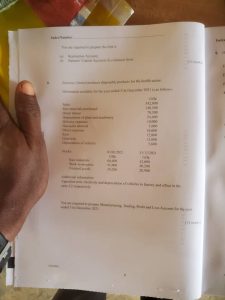

*_Question 2*_

(a) Gross Profit Margin:

The gross profit margin is a profitability ratio that measures the percentage of sales revenue that exceeds the cost of goods sold. It indicates how efficiently a company is using its resources to generate profits before accounting for operating expenses. The formula for gross profit margin is as follows:

Gross Profit Margin = (Gross Profit / Sales Revenue) x 100%

where Gross Profit = Sales Revenue – Cost of Goods Sold

(b) Net Profit Margin:

The net profit margin is a profitability ratio that measures the percentage of sales revenue that remains as net profit after accounting for all expenses, including operating expenses, interest, taxes, and any other deductions. It gives an indication of a company’s overall profitability and efficiency in managing its expenses. The formula for net profit margin is as follows:

Net Profit Margin = (Net Profit / Sales Revenue) x 100%

(c) Stock Turnover:

The stock turnover ratio measures how efficiently a company is managing its inventory by indicating how many times the company’s inventory is sold and replaced during a given period. It is calculated by dividing the cost of goods sold by the average inventory during the period. The formula for stock turnover is as follows:

Stock Turnover = Cost of Goods Sold / Average Inventory

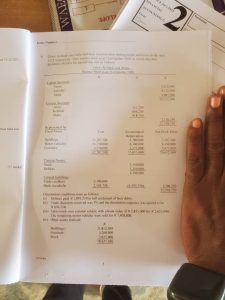

(d) Current Ratio:

The current ratio measures a company’s ability to pay its short-term liabilities from its short-term assets. It is calculated by dividing the company’s current assets by its current liabilities. The formula for the current ratio is as follows:

Current Ratio = Current Assets / Current Liabilities

(e) Quick Ratio:

The quick ratio, also known as the acid-test ratio, is a more conservative measure of a company’s ability to pay its short-term liabilities. It excludes inventory from the current assets used in the calculation, as inventory can be difficult to convert into cash quickly. The formula for the quick ratio is as follows:

Quick Ratio = (Current Assets – Inventory) / Current Liabilities

(3)

(i) Management/Owners

(ii) Investors/Shareholders

(iii) Lenders/Creditors

(iv) Employees/Workers

(v) Government Agencies/Tax Authorities

(i) Management/Owners: The management or owners of a business are interested in accounting information for various purposes. They rely on financial statements and reports to assess the financial performance of the business, make strategic decisions, evaluate profitability, monitor cash flow, and determine the overall financial health of the company. They need accurate and timely accounting information to effectively manage the business and plan for the future.

(ii) Investors/Shareholders: Investors and shareholders are interested in accounting information to evaluate the financial position and performance of a company. They use financial statements and reports to assess the profitability, liquidity, and solvency of the business. This information helps them make investment decisions, evaluate the company’s growth potential, and assess the value of their investments.

(iii) Lenders/Creditors: Lenders and creditors, such as banks or suppliers, rely on accounting information to assess the creditworthiness and financial stability of a business. They use financial statements, particularly the balance sheet and cash flow statement, to evaluate the company’s ability to repay loans or fulfill its financial obligations. Accurate accounting information helps lenders and creditors determine the level of risk associated with extending credit or lending money.

(iv) Employees/Workers: Employees and workers have an interest in accounting information, especially regarding their compensation and benefits. They rely on accurate accounting records to ensure proper calculation of salaries, wages, bonuses, and benefits. Accounting information also helps employees understand the financial health of the company, which may impact job security and potential growth opportunities.

(v) Government Agencies/Tax Authorities: Government agencies and tax authorities require accounting information to ensure compliance with tax regulations, financial reporting standards, and other legal requirements. They use financial statements, tax returns, and supporting documentation to assess tax liabilities, enforce regulations, and monitor financial transparency. Accurate accounting information is crucial for businesses to fulfill their legal obligations and avoid penalties or legal issues.

The essay is not clear

Please help us make it clear for the commerce

you pay