Table of Contents

WAEC GCE FINANCIAL ACCOUNTING ANSWERS 2020

Here is waec gce financial accounting answers 2020, share with your friends, and good luck.

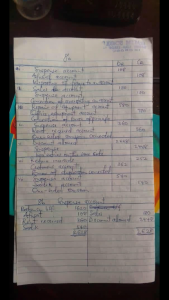

Financial Account-Obj

01 BAABDDDBAC

11 DABBDDCBAA

21 CACACCAACD

31 DBAABCACAA

41 BABBADDACC

financial accounting theory answers

*(1a)*

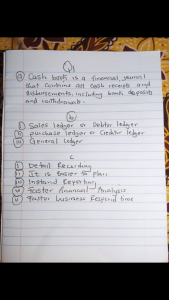

Cashbook is a book of original entry or prime entry which contains records of all cash and bank transactions.

*(1b)*

(i) Gengeral ledger

(ii) Nominal ledger

(iii) Personal ledger

*(1c)*

(i) it provide written records essential for proper conduct of business

(ii) it helps the business to ascertain profit or loss

(iii) it fascinates comparison within and between firms

(iv) it provide information for future planning (budgeting)

(v) it helps to ascertain tax payable by the business

Q3a

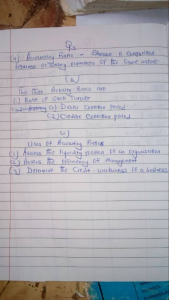

Accounting ratio is the comparison of two or more financial data which are used for analyzing the financial statements of companies. It is an effective tool used by the shareholders, creditors and all kinds of stakeholders to understand the profitability, strength and financial status of companies.

(3a)

Accounting ratio is the comparison of two or more financial data which are used for analyzing the financial statements of companies.

(3b)

(i) Total Assets Turnover Ratio

(ii) Return on Equity.

(iii) Asset Turnover Ratio.

(3c)

(i). Basis for comparison of two or more entities.

(ii). Measurement of financial performance of entity.

(iii). A tool for controlling operational performance.

(iv) Use of ratios as benchmarks.

(v). Analysis of trends:

(vi). Helpful in future planning. Related posts

1c

Pooling of financial resources

Easy in formation

Pooling of materials stall

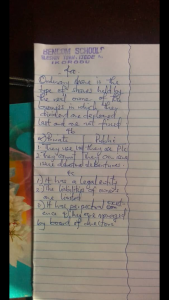

Q1a

A cash book is a financial journal that contains all cash receipts and disbursements, including bank deposits and withdrawals. Entries in the cash book are then posted into the general ledger.

(4a)

Ordinary shares: is defined as shares of a company that give shareholders the right to vote in the company’s meeting and also an income in the form of dividends from the corporation’s profits.

(4b) loading

Q1 *CASH BOOK* is a book of original entry or prime entry which contains records of all cash and bank transactions. In this cash book all cash and cheques received are debited and all cash and cheques paid are credited

1b GENERAL LEDGER

NOMINAL LEDGER

PERSONAL LEDGER

1c

1 it provide written records essential for proper conduct of business

2 it helps the business to ascertain profit or loss

3 it fascinates comparison within and between firms

4 it provide information for future planning (budgeting)

5 it helps to ascertain tax payable by the business

*(QUESTION 2a)*

I). Bankruptcy of the business.

ii). Dispute among members.

iii). Death of a partner.

iv). Withdrawal of a partner.

v). The end of the stated duration of the partnership.

*(3a)*

Accounting ratios are groups of metrics used to measure the efficiency and profitability of a company based on its financial reports. They provide a way of expressing the relationship between one accounting data point to another and are the basis of ratio analysis.

*(3b)*

(i)Inventory Turnover Ratio

(ii)Fixed Asset Turnover Ratio

(iii)Accounts Receivable Turnover

*(3c)*

(i)Activity Ratios help in comparison to businesses in the same line of operation.

(ii)Activity Ratios help in Problem identification c be done using the right and necessary corrections in the functioning of the business can be made.

(iii) Activity Ratios simplifies an analysis by providing the financial data in a simple format, which eventually helps in decision making.

(iv)Investors can rely on the information that Activity Ratios provide since it is based on numbers and is accurate.

(v)Activity ratios help in evaluating a business’s operating efficiency by analyzing fixed assets, inventories, and accounts receivables.

*(4a)*

Ordinary shares: is defined as shares of a company that give shareholders the right to vote in the company’s meeting and also an income in the form of dividends from the corporation’s profits.

*(4b)*

[Tabulate]:

– PRIVATE COMPANY

(i) A private company can sell its own, privately held shares to a few willing investors.

(ii) The stocks of a private company are owned and traded by only a few private investors.

– PUBLIC COMPANY

(i) A public company can sell its own registered shares to the general public

(ii) The stocks of a public company are traded on stock exchanges

cheers

I wanna pick a form for GCE 2021, i need guidelines and update on how to follow it.

But I can’t join the WhatsApp group because it’s said to be full.

What can i do?

Join now, its open