Waec financial accounting answers 2021

Here is the waec financial accounting answers for 2021. This is for free for you all… Enjoy it will it lasts.

Check back in few moments for the answers.

===============================

Obj:

F/Accounting-Obj:

1BDCBBACACC

11BBAABDDDCB

21CBADBDAADB

31BCBACBCAAA

41DDCDCCBBDA

===============================

Theory:

(3ai)

Entrance Fees or Admission Fees is the amount that a person pays at the time of becoming a member of a Not-for-Profit Organization. It is a revenue receipt. Therefore, we account it as an income and credit it to Income and Expenditure Account.

(3aii)

A subscription is a signed agreement between a supplier and customer that the customer will receive and provide payment for regular products or services, usually for a one-year period.

(3b)

(Pick Any five)

(i) No Opening Balance:- Opening balance is not require to prepare income and expenditure account.

(ii) Accrual Basis:- Income and expenditure account is maintained on accrual basis.

(iii) Based On Receipt And Payment Account:- Income and expenditure account is prepared on the basis of receipt and payment account at the end of the accounting year.

(iv) Non-cash Items:- This account records non-cash items also

(v) Debit And Credit Rule:- Expenses and losses are debited and incomes are credited as it is a nominal account.

(vi) No Capital Transactions:- Only revenue items are included in income and expenditure account. So, capital items are excluded while preparing this account.

(vii) Only Current Year’s Transactions:- Income and expenditure account includes only current periods transactions.

===============================

(4a)

Bank reconciliation statement: This is a summary of banking and business activity that reconciles an entity’s bank account with its financial records. In other words the statement outlines the deposits, withdrawals, and other activities affecting a bank account for a specific period.

(4bi)

Bank charges: These are charges that covers all fees made by a bank to their customers. In common parlance, the term often relates to charges in respect of personal current accounts or checking account.

(4bii)

Standing order: This is an instruction a bank account holder gives to their bank to pay a set amount at regular intervals to another’s account. The instruction is sometimes known as a banker’s order.

(4biii)

Credit transfer: This means a payment transaction by which a credit institution transfers funds to a payee’s account on the basis of a payer’s order, and the payer and the payee can be the same person.

(4biv)

Dishonoured cheques: These are cheques that a bank on which is drawn declines to pay. There are a number of reasons why a bank would refuse to honour a cheque, with non-sufficient funds being the most common one, indicating that there are insufficient cleared funds in the account on which the cheque was drawn.

(4bv)

unpresented cheque simply means that a cheque has been written and accounted for, but it has not yet been paid out by the bank from which the money is being drawn. Unpresented cheques are also referred to as outstanding cheques because the funds in question are, as the name suggests, outstanding.

(4bvi)

Uncredited cheques: These represent money that is available to the company but has not yet been recognised by the bank. This comes in the form of cheques paid in by customers and clients.

===============================

(1a) Accounting concepts are a set of general conventions that can be used as guidelines when dealing with accounting situations.

(1b)

(i) Business Entity: The business entity concept states that the transactions associated with a business must be separately recorded from those of its owners or other businesses.

(ii) Accrual: The accrual principle is an accounting concept that requires transactions to be recorded in the time period in which they occur, regardless of when the actual cash flows for the transaction are received.

(iii) Going concern: is an accounting term for a company that is financially stable enough to meet its obligations and continue its business for the foreseeable future.

(iv) Consistency: The concept of consistency means that accounting methods once adopted must be applied consistently in future

(v) Periodicity: The periodicity concept is a period during which business enterprises are required to prepare financial statement at specified intervals.

(vi) Historical cost: A historical cost is a measure of value used in accounting in which the value of an asset on the balance sheet is recorded at its original cost when acquired by the company.

===============================

(2ai)

Entrance Fees or Admission Fees is the amount that a person pays at the time of becoming a member of a Not-for-Profit Organization. It is a revenue receipt. Therefore, we account it as an income and credit it to Income and Expenditure Account.

SECTION B

===================================

Note; pls don’t mind the numbering in the page use the one we tag on top of it.

Note; pls don’t mind the numbering in the page use the one we tag on top of it.

===================================

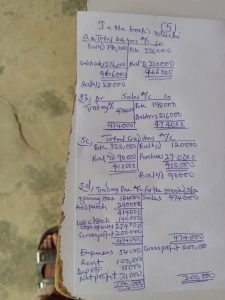

(5)

[img]https://i.imgur.com/JA4sh4J.jpg[/img]

===================================

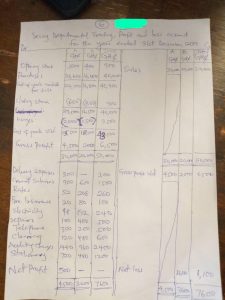

(6)

[img]https://i.imgur.com/THJfe6W.jpg[/img]

===================================

(7)

[img]https://i.imgur.com/bW9YQWs.jpg[/img]

===================================

(9)

[img]https://i.imgur.com/5ZOFIY2.jpg[/img]

===================================

(7)

Mark up to margin invoice

(a) 33⅓%

= 100/3 ÷ 100/1

= 100/3 × 1/100

= 100/300

= 1/3 + 1

= 1/4

(b) Good income 24,000

Profit = 1/4 × 24,000 = 6,000

Coat price = 24,000 – 6,000 = 18,000

(c) Goods return 320

Profit = 1/4 × 320 = 80

Cost price = 320 – 80 = 240

(d) Unrealised c/d = 1/4 × 11,520 = 2880

Cost price = 11,520 – 2880 = 8,640

(i)

Goods sent to Branch Account

DR

Goods returned 240

Trading Account 17,760

Total = 18,000

CR

Goods involved 18,000

Total = 18,000

(ii)

Branch stock Account

DR

Goods invoiced 24,000

Branch Advertisement A/c 7,840

Total = 31,840

CR

Sales 20,000

Goods returned 320

Balance c/d 11,520

Total = 31,840

(iii)

Branch Advertisement Account

DR

Goods returned 80

Gross profit 10,880

Total = 13,840

CR

Goods invoiced 6,000

Branch stock (supplies) 7,840

Total = 13,840

Answers will drop here soon